Author: Vlatko STOJANOVSKI

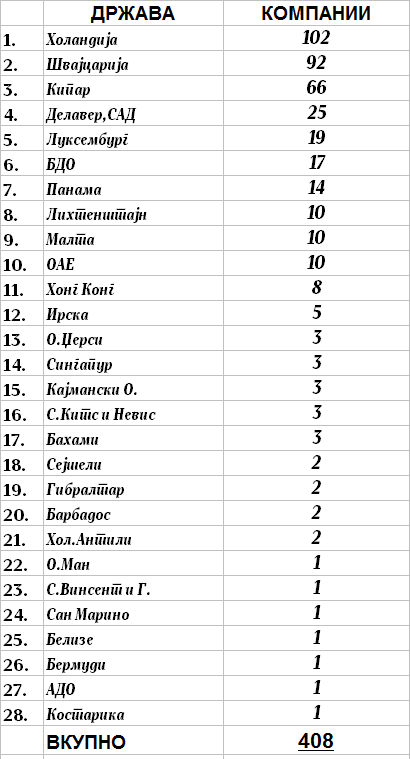

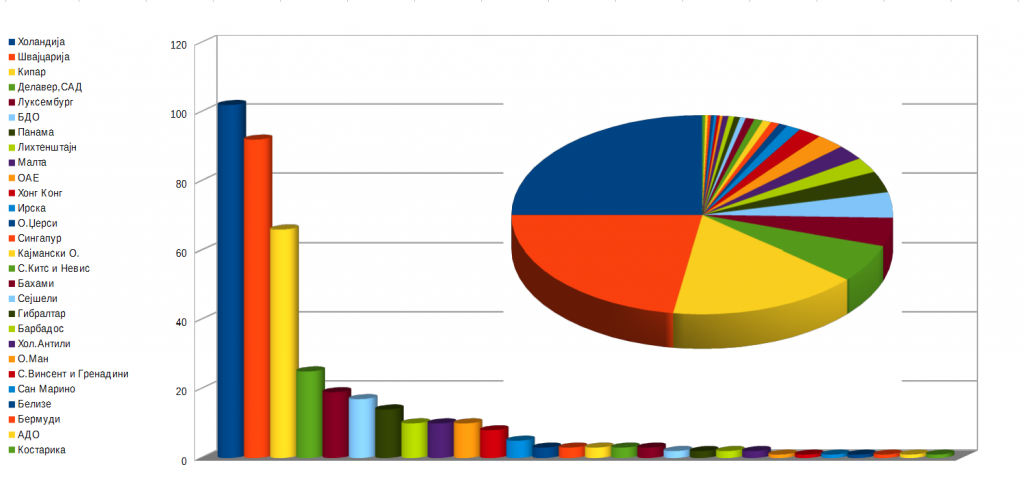

Over 400 companies registered in the country are fully or partially owned by other companies, headquartered in foreign countries that are known as specific jurisdictions, or offshore zones. As part of the research that we made, we found 408 legal entities in the Macedonian trade register, whose owners are not actually individuals, but other companies located in 28 foreign countries that are considered ас offshore areas.

According to the data we have provided, most of these companies have owners from various European countries known as countries that offer various financial benefits, but at the same time, they have mostly stable and reliable financial systems. Also, among them, there are countries known as „tax havens“ in Central America and along the Atlantic ocean, which offer the highest degree of discretion and privacy for the ownership structure of the company.

The official information that we received says that more than half of these companies have owners from three European countries – Netherlands, Switzerland and Cyprus. But, high on the list are classic offshore countries, such as Delaware, the British Virgin Islands, Panama, the United Arab Emirates and Hong Kong. Finally, there are numerous exotic destinations, such as Jersey, the Cayman Islands, St. Kitts and Nevis, the Bahamas and many more.

According to the legal changes that were made two years ago, any company owned by another foreign company have to register an individual as a final owner in the separate register within the Central Registry. But, such a register has not yet become operational. The official explanation for this is the corona crisis, as well as the fact that this Register should be linked to the Register of citizens, managed by other institution – the Ministry of informatics society and administration.

In fact, a Register of final owners is mostly needed by banks, notaries, lawyers, accountants, auditors and almost 6,000 other, which have a legal obligation to identify their clients and also to make an a analysis when they suspect in the data that received by their clients. In the last year, the Financial Intelligence Unit determined that some entities have violated this legal obligation.

In such a position, when there is a legislation to detect “hidden” owners in various foreign jurisdictions, but there is still no a Register where they would be recorded, Prime Minister Zoran Zaev presented the idea for importing foreign capital into the country. Some experts warn that such a process bring risk for legalization of doubtful capital owned by offshore companies with unknown owners.

CORONA-CRISIS DELAY THE REGISTER

In 2018, Government, based on the pre-election promises, proposed a completely new Law of Prevention of Money Laundering and Financing of Terrorism, which is in fact a harmonization of the old legal solution with the Directive of the European Parliament and Council for using of the EU financial system. For the first time, this Directive prescribes an obligation to introduce a separate register, as unify centralized mechanism for increasing the transparency of the ownership and control structure of legal entities.

This legal solution, adopted by the Parliament, requires all companies owned by other companies to discover the real owners. That means that companies owned by foreign companies must register individual or individuals as real or beneficial owners in the Register of real owners within the Central Register. However, almost two years later, such a Register is still no working.

The authorities from the Central Registry explains that the software of the Register of real owners is in the final stage of testing and integration with other systems. They said that the prolongation of the release of this system is the result of the covid-crisis, but also of the need for appropriate legislation. At the moment, as they said, there is a process of legal changes for connecting of the data between the Central register of citizens and the Register of real owners.

– First of all, the establishment of the register depends on appropriate legal framework that will enable the connection of this register with the Register of citizens, under the Ministry of Information Society and Administration. According to the regulation, primary this register will provide data for all registers which includes private data. The existing legislation does not allow that, so amendments were made to the law, but this process did not finished at time because of the elections and constitution of the Assembly – said Marija Boskovska-Jankovski, director of the Central Registry.

She explains that the Register of real owners is a software solution with a basic function – entering data of the entities ownership structure, by companies themselves or their legal representatives. At the same time, the director of the CR says that the system is a completely electronic solution, by entering data online, without submitting a paper or visiting an office. Thereby, Jankovski says, the obligation to control and verified entered data is concentrated in the competent entities.

– The function of the Register is evident. The Central Registry does not check the authenticity of the entered data, that kind of obligation have competent entities (banks, notaries, lawyers …) which establish business relations with the companies. There is a legal responsibility for the subject that reporting the data. If there is no match between reported data and factual situation, there is an opportunity to react the Financial Intelligence Office – says Boskovska-Jankovski.

IDENTIFICATION OF FINAL OWNERS

Measures and actions for detection and prevention of money laundering must be implemented by a total of 5,880 entities, as many as were registered at last 2019: law firms (2,743), accounting firms (2,115), exchange offices (224), notaries (187), banks (15) … Among other things, they are obliged to make an analysis of the clients with whom they establish a business relationship, especially if “there is a doubt about received data for the client’s identity “.

Otherwise, the entities are obliged to identify the final owner on the basis of “data and information from reliable and independent sources“, so they should by being convinced who is the ultimate owner. That means the entities must provide the necessary data from the original or certified documentation from the trade, court or other public register, or by checking the original or certified documents and business records. If they cannot secure data in this way, they are obliged to secure a written statement certified by a notary by the client.

Within the analysis of the clients, the entities are obliged to check the data received from the client and independently provided by the public register with the data entered in the Register of real owners. Well, if the real owner of the legal entity is not entered or updated in the Register, then the entity is obliged to delay the establishment of a business relationship until the data is entered. In such a case, the entity must immediately notify the Financial Intelligence Unit.

„The law directive about the Register will be applied from the moment when the Register will be established and put into full use. From that moment, legal entities have a deadline within which they will have to enter the ownership data. As for all other activities in the society, the corona-crisis slowed down the process of establishing this Register, but it has nothing to do with the identification of the final owners that the entities are obliged to continue to perform within the measures and actions to prevent money laundering and terrorist financing“, said from the Financial Intelligence Unit, which director is Blazo Trendafilov.

According to the Financial Intelligence Unit, all entities did not fulfilled this legal obligation, considering that in their annual report for 2019 is notify that one notary office and one accounting firm were punished, because they have established a business relationship with clients without determining the true/final owner before. However, they do not reveal names of the entities and clients, but they point out that when legal entities doubt the authenticity of the documents, they are obliged to inform their office, which after that produce indications for recognition of suspect transactions.

„Although the concept of „real owner“ is an old concept, it is known from practice that entities still have some difficulty in understanding and identifying the real owners. Entities often meet clients who have legal forms and organizations that are regulated in foreign countries, but are not recognized in national legislation. Same case is with the so-called legal arrangements, they have not always a status of a legal entity or identification marks“, said from the Financial Intelligence Unit.

INFLUENTIAL PEOPLE WITH POLITICAL RELATIONS AND MONEY LONDREY

Branimir Jovanovic, an economic analyst at the Vienna Economic Institute, believes that the delay of process of establishing the Register of real owners a year and a half because of the interests of the influential and powerful people connected with politicians from the past and present goverment, who, according to him, don’t want to know where they appear as final owners. He estimates that this process will be delayed for some time, which will be enough for the people behind these companies to clear the tracks.

– There are two main reasons for doing business through companies registered in off-shore destinations. The first is to avoid paying taxes, the second is to hide property. The first reason is more common globally, and we have such companies… The second reason became relevant in our country during the previous government, when many influential people and businessmen used off-shore destinations (like Belize) to hide that they themselves are owners of certain companies from this country, which were taking state tenders, etc. Even certain officials from the SDSM government had such relations – said Jovanovic.

In that context, he criticize Zaev’s idea of legalizing „untaxed” money by paying a 10 per percent tax. According to him, this idea is an upgraded version of the model of former Prime Minister Nikola Gruevski, who tried to push a constitutional changes to open financial zones, where should entered money from anywhere from the world. If Zaev’s idea will be realized, Jovanovic estimates that the country will become a „money laundering“state.

–Everyone will be able to legalize their „hidden” money, without any check of the origin, by paying a tax of only 10 percent. By comparison, global money laundering costs from 20 to 30 percent. So, it will be cheaper for criminals to launder their money legally in our country, than they do that in various illegal ways – said Jovanovic.

University professor and academic Abdulmenaf Bedgeti, reveals that the idea of importing foreign capital has been welcomed in a wider informal forum of experts. However, as he says, this concept should be properly designed in order to prevent to entry illegal capital. According to him, this should be enabled by a legal framework that will prohibit the entry of money of entities under investigation, regardless of whether they are individuals or companies.

– The goal is to have proper way for people who honestly earned money and now they decided to take them here. From a normative point of view, we as a state are very rigorous in this segment, but another aspect is how this legislation is implemented. There are legitimate and there are suspicious off-shore companies, but in a country where institutions do not function, like ours, these companies are problematic and suspicious, mainly by the aspect of the origin of capital – commented Bedgeti.

SPECIFIC JURISDICTIONS AND TAX OASES

Meanwhile, still unreported remain the owners of around 400 companies, which mostly lead to the Netherlands, Switzerland and Cyprus, where are located the owners of a total of 260 Macedonian legal entities, or more than half of the total determined number. Specifically, first on the list is Netherlands with 102 companies, after that is Switzerland with 93 companies, and on the third place is Cyprus with 66 companies.

Next country on this list are US federal state of Delaware and the European country Luxembourg, where the the founders of 25, and 19 Macedonian companies. Two less, or 17 companies in the country, are co-owned by companies located in the British Virgin Islands, part of the British Overseas Territories. Then comes the Central American country of Panama with 14 companies.

Total 30 companies are owned by companies from two European countries – Liechtenstein and Malta, as well as the United Arab Emirates, 10 companies by each of country. They are followed by Hong Kong and Ireland, where leads the capital relationship with 8, and 5 companies in Northern Macedonia. Companies from 5 other countries own 3 companies each: Jersey, Singapore, Cayman Islands, St. Kitts and Nevis and the Bahamas.

At the same time, companies from several classic off-shore zones own one or two companies in Northern Macedonia. Among them are Seychelles, Gibraltar, Barbados and the Netherlands Antilles, which are the base for the owners of a total of 8 companies. Finally, one company own other companies from Man, Saint Vincent and the Grenadines, San Marino, Belize, Bermuda and US Virgin Islands.

It should be pointed that in the records figure also the Marshall Islands, from where comes one of the co-owner of a domestic company, but this company is listed in Panama, because in the ownership structure there is an other co-owner from this country. This situation is the same with two other companies. One of them has co-owners from Jersey and Cyprus, and the other has from Liechtenstein and Malta.

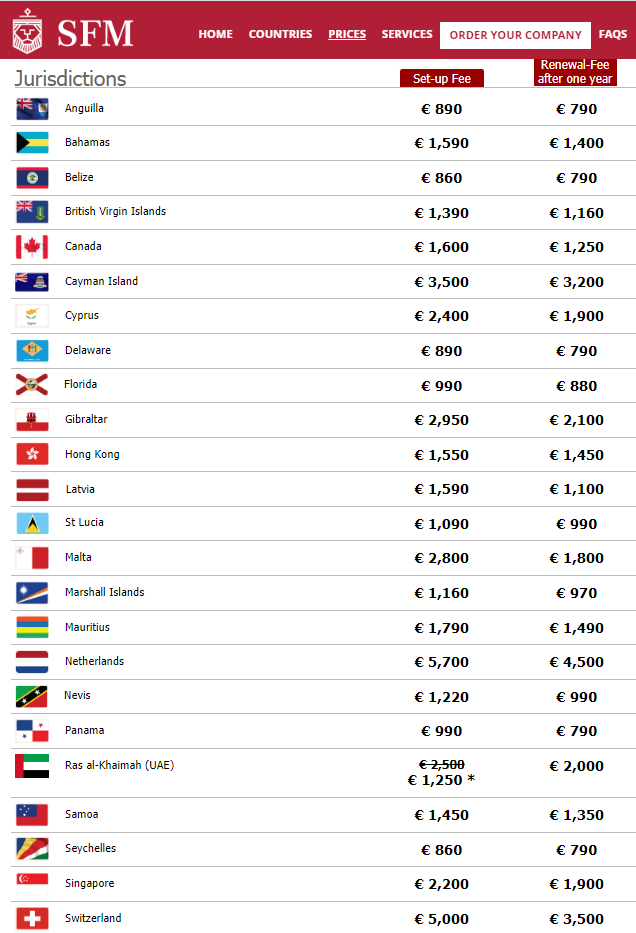

The common element for all these countries are the various financial and tax benefits for doing business, the minimum obligations related to documentation for registration and management of a company, and the protection of the identity of the owners. However, each country also has certain original characteristics. Depending on that, the price and cost of establishing an off-shore company varies.

TAX EXEMPTION AND DATA PROTECTION

In the price list of one of the most famous global providers for off-shore services – Swiss “SFM Group”, the most expensive destinations are the Netherlands and Switzerland, where the establishment of a company costs 5,700 and 5,000 euro. This service includes registration of the company by an agent, preparation and submission of the necessary certificates, payment of local fees, etc.

According to the cost of opening an offshore company, the cost in Cayman is 3,500, in Gibraltar 2,950, in Malta 2,800, in Cyprus 2,400, in Singapore 2,200, in the Bahamas 1,590, in Hong Kong 1,550, in the British Virgin Islands 1,390, in St. Keats and Nevis 1,220… The cheapest options, with cost under a thousand euros, are: Panama (990), Saint Vincent and the Grenadines (990), Delaware (890), Belize (860) and Seychelles (860).

The most expensive Netherlands and Switzerland are considered to be one of the economies with the most stable legislation and excellent infrastructure, which numerous agreements for avoiding double taxation. Liechtenstein is one of the countries with the lowest tax rates on the continent also. Other European countries have similar characteristics. Cyprus is characteristic by the banking system, Malta by financial services, Luxembourg by services industry, etc.

Related to Asian jurisdictions, Singapore is famous because of attractive tax rates, there is still an extremely low level of corruption, and 100 percent foreign ownership is allowed. This list includes Hong Kong, where it does not charges property tax or dividend tax. In UAE there are no foreign exchange controls and trade barriers.

Most of these countries are considered as major global financial and business centers, and some even offer certain level of protection of the private data, with the fact that in certain countries, such as the UAE, the identities of owners and shareholders are kept secret by law. However, this is more typically about the classic off-shore destinations, mainly located in Central America and over the Atlantic.

According to the company “Offshore Company Corp.” specialized for corporate services, maximal level of confidentiality, anonymity and privacy offering British Virgin Islands, Belize, Bahamas, Saint Vincent and the Grenadines, Panama, Saint Kitts and Nevis, Seychelles. Almost everywhere in these countries, the data for owners and shareholders are not public. In addition, the companies are released from all local income taxes, there is no control over the transfer of funds, etc.

NOMINATED SHAREHOLDER OR FUND

With intention to form a complete picture about the possibilities that offer these offshore destinations, we got in touch with renowned providers, representing as Macedonian businessmen interested to open an off-shore company with a maximum possible protection of the ownership. So, one of these providers Mauritius told us that Samoa, Seychelles, Belize, Marshall Islands, Cayman Islands are among the jurisdictions that strictly keep the privacy of the ownership file.

„But, we recently heard that the Cayman Islands may release ownership files in a few years. So, if you want to start a holding company with private ownership records, you can look some of the others jurisdictions. The companies in Samoa and the Marshall Islands do not have a request to submit a director, while the others have a request for a director in private records. This information is available to the public in the Cayman Islands“, they explained.

International company located in Estonia, points that classic off-shore zones such as the Seychelles, Belize, Saint Vincent and the Grenadines offer privacy for the ownership, but it is difficult to open a bank account in Europe. So, they as a best option recommend Hong Kong, because it is a prestigious Asian jurisdiction, with an available service for nominees. Most importantly, they said that there is no official exchange of information between the countries.

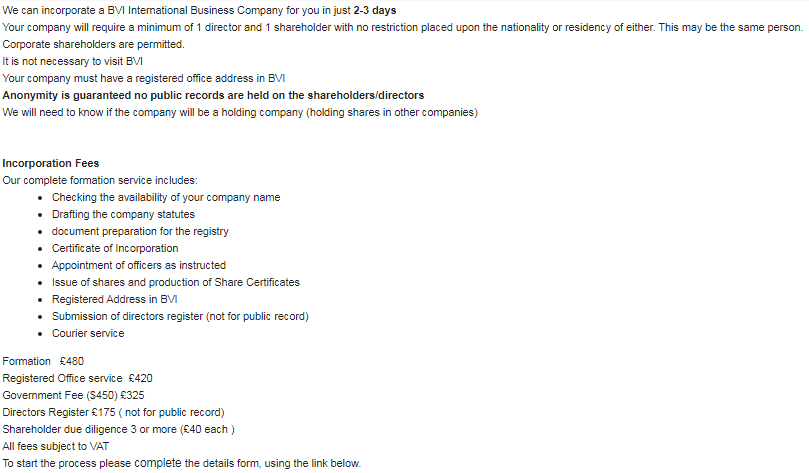

Another company from London for this kind of services believes that the British Virgin Islands are the most favorable option, because a company can be opened in 2-3 days, with only 1 director and 1 shareholder, without restrictions on nationality or residence. Also, the director and the shareholder can be the same person older than 18 years, who does not have to visit the British Virgin Islands, where will be settled the official office of the company.

According to almost all operators that we contacted with, in almost all classic off-shore destinations have to be reported an beneficial owner of the company, which is still kept in strict secrecy unless such information is required by a state authority for a certain procedure. But, one of them suggested that best model for protection of the owner’s identity is establishing a fund.

–If you do not want your name to be displayed as the owner of the company, then the only real option would be to establish a fund that would keep the shares of the company. However, this type of service is more expensive depending on where the fund is located. Other options could be to use a nominated shareholder who will be listed as the company’s shareholder on the documents, but you will obviously need to be listed as a UBO (ultimate beneficial owner)-said D.Tidhlar, a business consultant from provider from Dubai, which almost 30 years successfully works on the market.

In the next part of this serial we will process a significant part of these 408 companies. Among them there are a „daughter companies“ and subsidiaries of well-known and renowned international groups. But, there are also a lot of mysterious companies with unknown final owners. Some of them lead to the people from business, politics, sports and other segments.

This research story has been produced with the financial support of the European Union. Its content is the sole responsibility of the author and in no way reflects the views of the European Union.